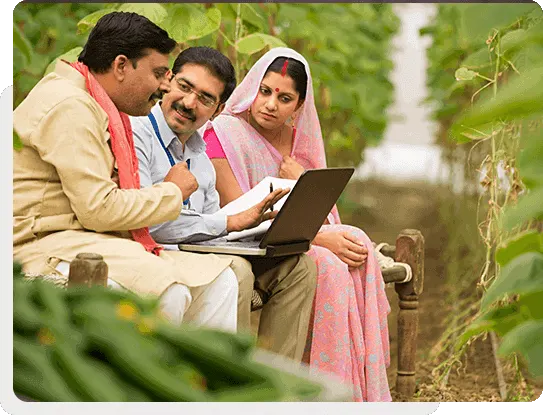

Access a comprehensive financial solution for your brand-new tractor with ease. Our Tractor Loans offer a hassle-free documentation process and swift loan approvals, ensuring you can acquire the ideal tractor without delay. We provide funding of up to 90% for the tractor of your choice through a streamlined procedure.

Forget the hassle of income documentation because our no-income document option is available, bringing you one step closer to owning your dream tractor. We’ve designed the repayment schedule to align with the crop cycle, allowing you to repay at your convenience. You have the flexibility to choose from various repayment methods, including ECS, post-dated cheques, or online payments. Take the first step towards turning your dreams into reality by applying for a Tractor Loan online today.

We are dedicated to ensuring your loan journey is seamless, allowing you to experience the joy of owning a new tractor. Enjoy benefits like maximum funding, immediate loan approval, the option of a no-income document scheme, and much more.

Our paperwork process is simple and easy to follow. Get your loan documentation done with minimal effort.

Own a new tractor with the best features without hampering your budget. Enjoy loan-to-value financing of up to 90%* with our tractor loans.

No long waiting hours with our quick loan process. Submit the right documents and get instant approval on your tractor loan.

We have simplified the loan application process. You can apply for our Tractor Loans without any traditional income documentation.

| Schedule of Charges | Charges (inclusive of GST) |

|---|---|

| Processing Fees | Upto 10% |

| Penal Charges | 36% Per Annum on unpaid installment |

| Foreclosure Charges | a) Remaining loan tenure is <=12 months - 6% on principal outstanding b) Remaining loan tenure is >12 months - 5% on principal outstanding |

Other Charges |

| Bounce Charges | Rs.750 |

| Duplicate NDC/NOC Charges - physical copy | Rs.500 |

For a complete list of charges, please click here

Plan your budget and make your life easy with the tractor loan calculator. Get the total amount payable, EMI and processing fee, and other important information calculated in advance.

Disclaimer : These results are for indicative purposes only. Actual results may vary. For exact details, please contact us.

Here’s all that you need to know about your eligibility for a tractor loan.

Decide the tractor for which you want to avail of the Loan.

Upload the required documents and get your Loan approved.

After approval, get your Loan disbursed without any delay.

Welcome back! Submit the below-mentioned details and get a new tractor loan.

At TVS Credit, we provide tractor loan with affordable interest rates ranging from 11%-25%

Tractor loans come under the category of agricultural loans. This Loan can be availed by farmers, non-farmers, individuals or as a group. At TVS Credit, the repayment options have been matched with the crop cycle for the borrower’s convenience.

Here’s why you should consider TVS Credit tractor loan.

At TVS Credit, the maximum loan amount for a tractor loan that can be borrowed to purchase a tractor is up to 90% of the tractor’s price.

Depending on the type of tractor loan opted for, the tenure ranges from 12 to 72 months.

Documentation and paperwork for applying for a Tractor Loan, generally can be a tiring and tedious activity. We at TVS Credit, help you save your valuable time without having to deal with lengthy offline process. Apply from the comfort of your home and get your Tractor Loan sanctioned in as quick as 3 hours. *T&C Apply

Sign up for latest updates and offers