A Personal Loan is an unsecured loan that can be used to cover a variety of needs, including paying for a wedding, a vacation, unexpected medical costs, credit card debts, and more. These loans are easier to obtain and hassle-free because they don’t demand any security or collateral. An Online Personal Loan enables you to get instant loan, as funds are generally disbursed immediately.

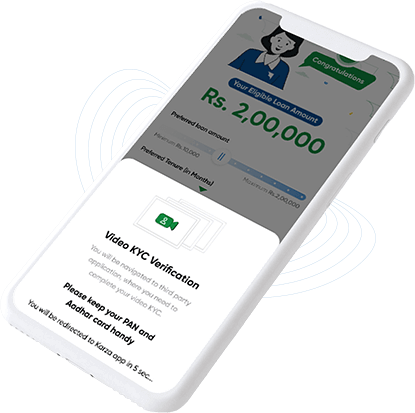

We offer instant personal loans with minimal documentation in a 100% paperless manner. Download TVS Credit Saathi App from Play Store or App Store, apply from the comfort of your home, from your preferred mobile device and get the loan amount required credited to your bank account.

Explore how an instant personal loan online can make your life easy. Enjoy the benefits of Online Personal Loans with a hassle-free application process and quick approval to meet your financial goal in a seamless manner.

Personal Loan interest rates varies depending on the customer profile. There are other charges as well apart from the interest rates, read below to understand better.

| Schedule of Charges | Charges (inclusive of GST) |

|---|---|

| Processing Fees | Upto 10% |

| Penal Charges | Upto 36% per annum on unpaid installment |

| Foreclosure Charges | Cooling Period of 15 days from the Loan Agreement date. Charge as % of Principal outstanding. 16 days 12 months: 7.08%, 13-24 months: 4.72% >24 months: 3.54% | Other Charges |

| Bounce Charges | Rs.0 - Rs.750 |

| Duplicate NDC/NOC Charges | Rs.0 - Rs.500 |

For a complete list of charges, please click here

Experience quick online loan approval and hassle-free steps to get your instant Personal Loan today!

Experience quick online loan approval and hassle-free steps to get your instant Personal Loan today!

Personal Loan eligibility criteria

Calculate your monthly installments with our Personal Loan EMI calculator - Get accurate Loan EMI and Personal Loan interest details instantly

Disclaimer : These results are for indicative purposes only. Actual results may vary. For exact details, please contact us.

₹ 50,000 to ₹ 5 Lakhs*

16% to 35% Annualised ROI

6 to 60 months

2% to 6%

ILLUSTRATION

For ₹ 75,000/- borrowed at Interest rate’ of 2% p.m. for 12 months (interest rate on reducing balance method),the payable amount would be Processing fee’ ₹ 1500. Interest ₹ 10,103. The total amount to be repaid after a year will be ₹ 86,603.

*Interest rate and processing fees varies as per the products.

Whether you are looking for the best personal loan interest rates or easy application process, our Online Personal Loan enables you take full advantage of flexible financing solutions. No matter the challenge, a digital personal loan is the solution that fits.

A personal loan allows you to borrow money from a lender for almost any purpose, such as debt repayment, financing a large purchase, or planning a wedding. online personal loans at TVS Credit are hassle-free to apply for, and we disburse the loan within 24 hrs.

Applying for an online personal loan with us is open to all salaried individuals earning over Rs.25,000 per month and individuals with a CIBIL score of over 700. You can also review other eligibility criteria. With a TVS Credit Personal Loan, you can obtain financing within 24 hours.

Disbursal of our online personal loans usually happens within 24 hours after the successful completion of the digital journey. The application process is simple, fast, and paperless. We also offer personalized guidance to help you complete the application process without any issues.

No, we do not offer online personal loans to unemployed borrowers yet. However, salaried individuals who earn Rs. 25,000 and above per month can apply for our Personal Loan. Check your eligibility and get disbursal within 24 hours with our paperless process. Our digital companion TIA is available to assist you in completing the digital journey without any hassles.

The advantages of online personal loans from TVS Credit are:

Before you borrow money, calculate the amount you need to pay by budgeting the installments and paying off your bills by consolidating them. Be mindful of the terms of the loan. If you have multiple debts or high-interest loans, consolidating them into one online personal loan and paying it off makes sense. Make sure you pay your installments without fail, as it might negatively affect your credit score and reduce the chance of getting a loan in the future. A good credit history and score show creditors that you maintain your credit commitments by making timely payments.

online personal loans allow you to borrow up to Rs. 5 lakhs, starting at Rs. 50,000. Apply for a personal loan online and get disbursal within 24 hours with an easy and quick process with no paperwork.

One can apply for personal loans for reasons like paying for college, making a down payment for a house, launching a business, emergencies, weddings, travel, paying for the necessities of life, or paying for pricy credit card debt. The personal loan should have a lower interest rate than your current debt to enable you to pay it off more quickly. online personal loans let you cover unexpected costs without depleting your savings as they follow a routine payment schedule. They provide the ability to combine high-interest loans and can also be used to pay for your wedding or a dream vacation.

An online personal loan offers many advantages, but it’s vital to realize that defaulting on a personal loan might affect your credit score. Being judicious in choosing your loan will help you save a lot of hassle. To understand and manage your finances, visit TVS Credit and use the EMI calculator. Enter the necessary information to calculate your monthly EMI and select a tenure. You can pay back the loan amount without hurting your pocket by using several payment options.

No, cancellation is not possible once the customer has completed the digital signature, as the signature indicates the disbursal of the agreed-upon online personal loan amount. Learn more about your eligibility and receive personalized guidance. For further assistance, reach out to TIA to better understand.

At TVS Credit, applying for an online personal loan is simple, quick, and paperless. You don’t need any documents to apply for a personal loan. Just have your Aadhar details, PAN details, and current address proof on hand and fill out the required information. You can receive your loan within to get your loan now.

A personal loan is not secured since it does not require any collateral to get one. Obtaining the best personal loan is easy because TVS Credit offers instant personal loans that are paperless and simple. Visit the TVS Credit website, avail yourself of an online personal loan, and start living the way you want.

Yes, TVS Credit Saathi is an app for obtaining an online personal loan with TIA to further assist you. The process is simple and paperless, and disbursement occurs within 24 hours of the successful completion of the digital journey. Use the EMI calculator available on our website to help you understand the amount you must pay each month.

No, online personal loans are not taxable.

The process for getting an online personal loan at TVS Credit is as follows:

For an online personal loan from TVS Credit, we charge a processing fee ranging from 2 percent to 5 percent of the loan amount. One can apply for an instant personal loan, and TVS Credit has a competitively low interest rate, and the loan disbursal occurs within 24 hours. The entire process is paperless.

By using the EMI calculator you can calculate online personal loan EMIs. You can select the term you want to utilize and figure out your monthly payments free of hassle.

The most common usage of an online personal loan involves paying for a long overdue trip and family events like weddings and birthday celebrations. These are also commonly used for large purchases, debt relief, emergency expenses like medical emergencies, banking, education, and electronic purchases. They are also frequently used for making down payments on a house or a car.

The term for TVS Credit's online personal loans ranges from 6 to a maximum of 60 months. At TVS Credit, you can choose your preferred tenure at your convenience and apply for the loan. We also provide friendly assistance throughout to make the application process easy and quick for you.

TVS Credit offers the following Loans

Sign up for latest updates and offers