Are you planning to get into an agriculture business?

Or are you already into farming?

You must know farming is expensive! Starting up and running a farm can cost you a bomb!

It is most likely you will need financing, and that’s exactly when farm loans come into the play.

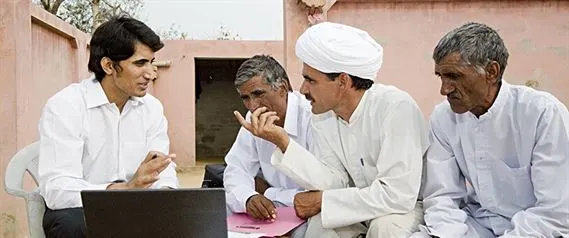

Getting an agricultural loan can be a challenging task. At times, it is difficult to even get into the lender’s door. A farm loan approval needs a lot of homework. It can be an easy task if you have clarity on how much money you need, why you need it and how you are going to pay it back.

Here are some of the most important things to do before you apply for an agriculture loan:

1. Have a suitable business plan

If you just walk up to a lender and say, “I need finance for my agriculture business”, there is a 99 percent chance your loan will not be approved. On the other end, if you go with a proper business plan, the lender will know that you have clarity on what you want to do, where you want to invest, how you will invest and how will you repay off the loan. Make sure your business plan include your background information, mission, goals, objectives, and marketing plan.

2. Ensure your financial statements in place

This is one of the most important steps, as all lenders will want to know if you will be able to pay back the money that you borrowed from the bank. Any lender you approach is going to check your financial ability to repay the loan by reviewing your financial documents like income statement, cash flow statement, farm balance sheet, and business history.

3. Keep your collateral ready

Collateral are your assets that you own and that a bank can use as a recovery, if at all you fail to repay the loan. You must have an asset worth the loan. Make sure you are ready with the answer if you are asked, ‘What assets can you pledge?’ If you have got a non-farm asset worth the loan, the chance of getting your loan approved increases.

4. Prepare yourself for general questions

Though you might think this is very obvious, do not take it for granted. On the basis of the way you answer to the general questions like qualifications and past experience, the lender might determine if your business plan will be fruitful or if you will be able to repay the loan. So, if you want to create a good impression on a lender, you must prepare for the general questions.

If you are ready with the above mentioned things and have your plan in place before you approach the lender for a loan, there are high chances they will approve your loan. Once you get it, you can make an optimised use of the finance in purchasing farm equipment and supplies, refinancing an older loan, improving land with repair work, and marketing campaigns and advertising. A lot of banks also provide tractor loans separately. So, you can check tractor loan interest rate online and then go for it!